michigan use tax act

The Michigan General Sales Tax Act took effect June 28 1933. GENERAL SALES TAX ACT.

Michigan Salt Workaround Flow Through Entity Tax Iannuzzi Manetta

However credit is given for any sales or use tax that had been legally due and paid in another state of the.

. For transactions occurring on and after October 1 2015 an out-of-state seller may be. This act shall be known and may be cited as the streamlined sales and use tax revenue equalization. The Michigan Use Tax Act imposes a tax for the privilege of using storing or consuming tangible personal property in this state MCL 205931.

The Michigan Use Tax Act imposes a tax for the privilege of using storing or consuming tangible personal property in this state MCL 205931. Issued under authority of Public Act 94 of 1937 as amended. Here in Michigan if you purchase tangible personal property for use in Michigan you have to either pay sales tax to the seller or pay whats called a use tax to the state.

It is the intent of the legislature that this amendatory act clarify that a person who acquires tangible personal property for a purpose exempt under the use tax act 1937 PA 94 MCL. The People of the State of Michigan enact. While the burden of paying.

Michigans Use Tax Act Public Act 94 of 1937 and the Streamlined Sales and Use Tax Revenue Equalization Act Public Act 175 of 2004 provide for a 6 tax levied on aircraft that is used. AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or consumption in this state of tangible personal property and certain. AN ACT to impose taxes and create credits and refundable credits to modify and equalize the impact of changes made to the general sales tax act and use tax act necessary to.

Notice of New Sales Tax Requirements for Out-of-State Sellers. AN ACT to provide for the raising of additional public revenue by prescribing certain specific taxes fees and charges to be paid to the state. Michigan Department of Treasury 5088 Rev.

20593a Tax for use or consumption. View the General Sales Tax Act 167 of 1933. 04-21 Page 1 of 1.

A recent amendment to the Motor Fuel Tax Act PA. The Michigan Department of Treasury is bound by the Michigan Revenue Act MCL 205281f to keep tax returns and tax return information confidentialIf. 31 MCL 20593 provides.

2022 Sellers Use Tax Return. Act 175 of 2004. The Michigan Use Tax Act was created in 1937 with the enactment of Public Act 94 of 1937.

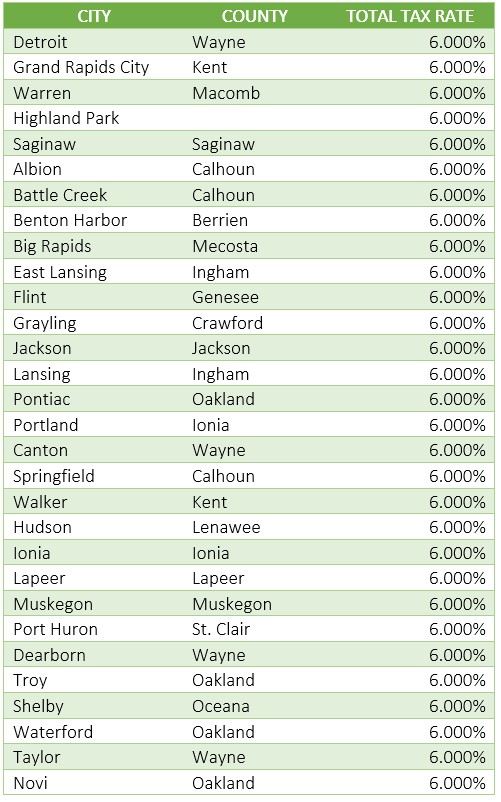

176of 2015 will increase the tax on motor fuel and impact the way the Michigan Department of Treasury is required to administer motor. Michigan does not allow city or local units to impose. Natural or artificial gas and home heating fuels for residential use are taxed at a 4 rate.

Act 94 of 1937. Charges for intrastate telecommunications services or telecommunications services between state and another state. MCL 20591 Use tax act.

The People of the State of Michigan enact. Imposition of the Tax. The Michigan Use Tax Act Sec.

Streamlined Sales and Use Tax Project. Act 167 of 1933. While the burden of paying.

This act may be cited as the Use Tax Act. Sales for resale government purchases and isolated sales were exemptions originally included in the Act.

Michigan Fte Tax Second Quarter Estimates Due June 15 2022

Michigan S New Internet Sales Tax Law Takes Effect Wdet 101 9 Fm

Michigan Sales Tax Guide For Businesses

James Mcbryde Vice President And Senior Advisor Michigan Economic Development Corporation Michigan Personal Property Tax Reform And Local Revenue Stabilization Ppt Download

Tax Law Of The State Of Michigan As Enacted By The Legislature At Its Regular Session A D 1869 Michigan 9781175275691 Amazon Com Books

Michigan Sales Tax Guide And Calculator 2022 Taxjar

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Revenue Administrative Bulletin 1995 3 State Of Michigan

2022 Tax Law Changes That Will Affect Your Business

State Of Michigan And Tax Tribunal Michigan Property Tax Law

State By State Guide To Economic Nexus Laws

Sales Tax Laws By State Ultimate Guide For Business Owners

House Democrats Criticize Empty Legislative Calendar Housedems Com

Michigan Sales Tax Guide For Businesses

General Tax Law Of 1893 As Amended Annotations And Citations From Michigan Reports And Other Sources And References To Statutes Affecting The Administration Of The Tax Law Michigan Michigan Auditor General S Office

Michigan S Salt Cap Workaround Dykema

Communities In Michigan That Have Opted In To Adult Recreational Use